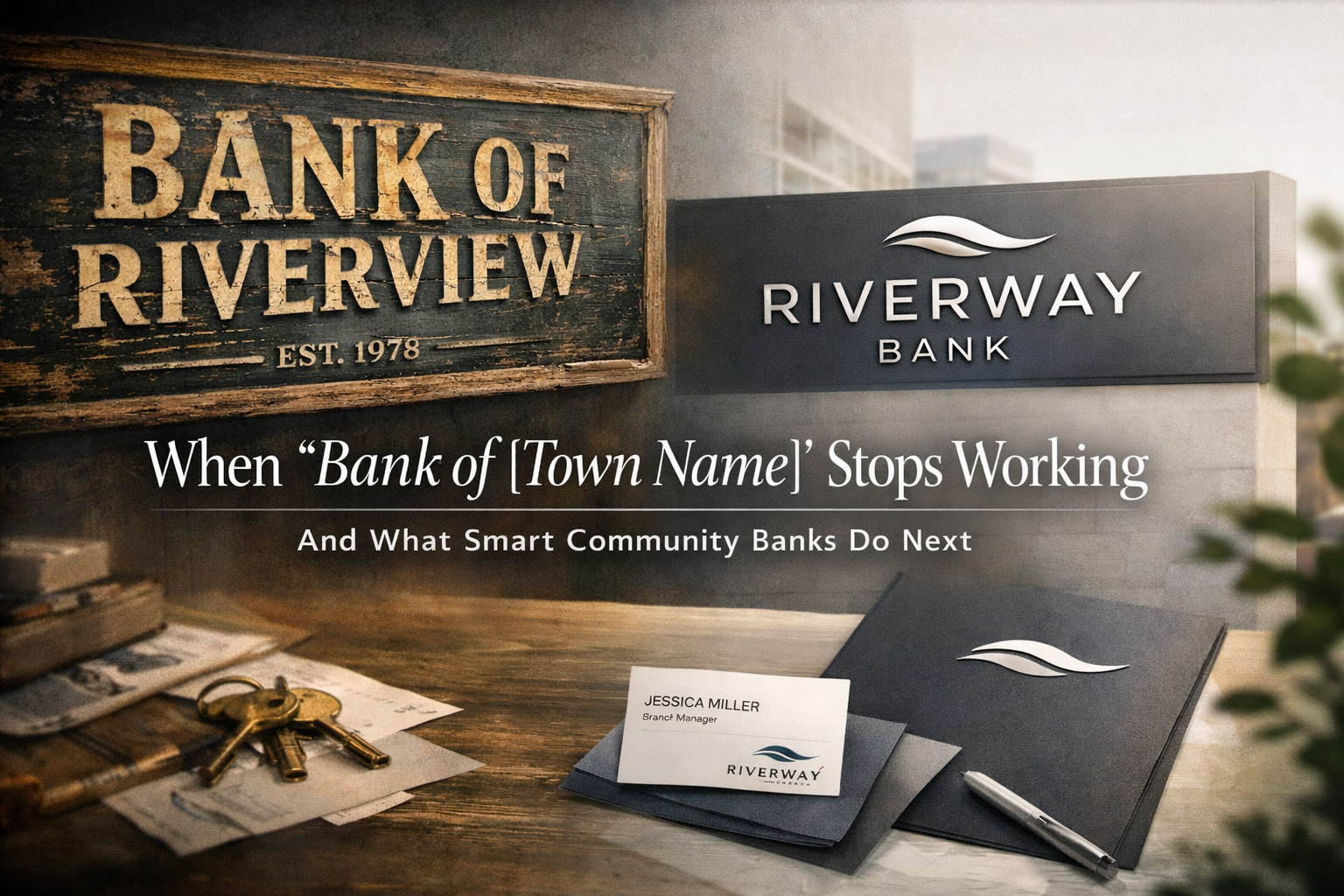

When “Bank of [Town Name]” Stops Working (And What Smart Community Banks Do Next)

At some point, many community banks hit the same awkward milestone.

The balance sheet is healthy.

The footprint is growing.

The customer base is no longer just local.

And suddenly, the name “Bank of [Town Name]” feels… limiting.

Because while it signals hometown trust to one audience, it quietly raises eyebrows with another.

“Wait… why would I bank with the Bank of Somewhere Else?”

That moment—when growth outpaces identity—is where rebranding enters the conversation.

The Geography Problem No One Wants to Talk About

Community bank names are often rooted in place for a good reason:

Trust

Legacy

Familiarity

But geography-based names come with built-in assumptions.

If your institution is called “Bank of Maple Grove,” consumers in neighboring towns may subconsciously think:

“That’s not really for me”

“They probably only serve locals”

“This feels small”

Even if none of that is true.

As banks expand through new branches, mergers, or digital offerings, the name that once built trust can quietly become a barrier to growth.

Rebranding a Bank Is Not the Same as Rebranding a Startup

This is where a lot of rebrand advice goes wrong.

Banks are not DTC brands.

They are not tech startups.

They cannot pivot identities overnight without consequences.

A bank rebrand must protect:

Depositor confidence

Regulatory clarity

Brand equity built over decades

The goal isn’t reinvention.

It’s strategic evolution.

Three Smart Paths Community Banks Take

There’s no one-size-fits-all approach, but successful bank rebrands usually fall into one of three categories.

1. The Full Name Evolution

Some banks choose to shed geographic specificity altogether—moving toward a broader, more flexible brand identity.

This doesn’t mean abandoning trust. It means reframing it.

Often, these rebrands:

Keep legacy elements (colors, symbols, tone)

Introduce a name that scales regionally

Emphasize values over location

This path works best when expansion is a core long-term strategy.

2. The “Brand-Forward, Name-Stable” Approach

Not every bank needs a new name.

Some institutions keep their original name but shift how prominently it’s positioned, letting brand personality and experience do the heavy lifting.

Strong examples across the industry show that consistency, clarity, and confidence can outweigh literal geography. Institutions like Huntington Bank and Regions Bank have expanded well beyond their original footprints by building strong, recognizable brands that feel bigger than their names.

The takeaway: a name doesn’t have to change if the brand outgrows it.

3. The Hybrid Expansion Strategy

Some banks strike a middle ground:

Keep the legal name intact

Introduce a consumer-facing brand refresh

Emphasize regional service rather than a single town

This approach minimizes risk while opening the door to broader appeal—especially during phased expansion or post-merger integration.

It’s cautious. Intentional. And often very effective.

What Consumers Actually Care About

Here’s the good news: most consumers aren’t obsessed with your name.

They care about:

Whether your bank feels trustworthy

Whether it feels modern and capable

Whether it understands their needs

A rebrand succeeds when it answers one simple question:

“Does this institution feel like it belongs in my financial life?”

That feeling comes from clarity, consistency, and experience—not just naming.

Rebranding Considerations Unique to Community Banks

Before touching colors, logos, or names, community banks should ask:

Does our current brand limit perceived service area?

Are we expanding digitally, physically, or both?

How much equity exists in our current name?

What level of change will customers tolerate?

How will regulators and internal teams respond?

Skipping these questions leads to cosmetic rebrands that look nice—but solve nothing.

Growth Doesn’t Require Erasing Your Roots

The strongest bank rebrands don’t reject their history.

They translate it.

They take decades of trust and present it in a way that feels relevant, confident, and scalable—without alienating the customers who built the institution in the first place.

You don’t need to stop being a community bank to grow.

You just need a brand that can grow with you.

Thinking About a Bank Rebrand?

Ritner Digital helps community banks evaluate when rebranding makes sense—and when it doesn’t. We guide institutions through naming considerations, brand evolution, and digital rollouts that respect legacy while supporting growth.

If your bank’s footprint has outgrown its brand, let’s talk about what comes next.

👉🏼 Connect with Ritner Digital for a strategic rebrand conversation.

Frequently Asked Questions

When should a community bank consider rebranding?

Most banks don’t wake up one day and want a rebrand. The conversation usually starts when something changes:

Expansion into new towns or regions

A merger or acquisition

A shift toward more digital-first services

Declining engagement from younger or non-local customers

Rebranding isn’t about fixing what’s broken—it’s about aligning identity with reality.

Is a geographic bank name actually a problem?

Not always—but sometimes.

Names like “Bank of [Town Name]” build strong local trust, yet they can create subtle hesitation among consumers outside that area. People often assume the bank isn’t meant for them—even when it is.

The question isn’t “Is the name bad?”

It’s “Does the name limit perception as we grow?”

Do we have to change our name to rebrand?

No—and many successful banks don’t.

Rebranding can include:

Visual identity updates

Messaging and positioning changes

Website and digital experience improvements

Brand architecture refinements

A name change is the most visible—and riskiest—option. It should only happen when the strategic upside clearly outweighs the disruption.

How do banks rebrand without losing existing customers?

The key is evolution, not erasure.

Strong bank rebrands:

Preserve recognizable brand elements

Communicate changes clearly and early

Emphasize continuity of service and values

Roll out updates in phases

Customers don’t fear change as much as they fear uncertainty.

How long does a bank rebrand typically take?

A full rebrand is not a quick sprint.

It often includes research, stakeholder alignment, regulatory review, design, and phased rollout. The timeline depends less on creativity and more on approvals and coordination.

A thoughtful pace builds confidence internally and externally.

How do regulators view bank rebranding?

Regulators don’t oppose rebranding—but they do care about clarity and consistency.

Rebrands must:

Clearly communicate the legal entity

Avoid misleading messaging

Maintain transparency for customers

When compliance and legal teams are involved early, rebranding is rarely a regulatory issue.

Can we expand into new markets without rebranding?

Yes—and many banks do.

Some institutions grow successfully by strengthening brand presence, improving digital experience, and emphasizing regional service—without touching the name.

Rebranding is a tool, not a requirement for growth.

What’s the biggest mistake banks make when rebranding?

Treating rebranding as a design project instead of a strategic one.

Logos and colors matter—but without clear positioning, customer insight, and internal alignment, a rebrand becomes expensive window dressing.

The smartest rebrands start with strategy, not aesthetics.

How do we know if a full rebrand or a lighter refresh makes more sense?

That depends on:

Growth plans

Brand equity in the current name

Customer perception across markets

Internal risk tolerance

A structured brand assessment usually reveals whether a bank needs transformation—or simply clarification.

Why work with Ritner Digital on a bank rebrand?

Ritner Digital understands the unique pressure points of rebranding in regulated, trust-based industries.

We help community banks:

Evaluate naming and positioning objectively

Balance legacy with growth

Navigate internal and regulatory considerations

Roll out rebrands that feel confident—not disruptive

Our goal isn’t to make your bank look different.

It’s to make your brand work harder for where you’re going.

What’s the first step in a bank rebrand?

Start with a strategic conversation.

Before any creative work begins, it’s critical to understand:

Where the brand helps

Where it holds you back

What customers actually perceive

From there, rebranding becomes a decision—not a leap of faith.

Related Reads

〰️

Related Reads 〰️

Why Community Bank Websites Are Stuck in the Past (And How to Modernize Without Giving IT a Heart Attack)

Community banks operate in one of the most security-conscious environments in the world—and that reality often keeps their websites stuck in the past. Modernizing a bank website isn’t about flashy design or risky access. It’s about evolving safely, respecting compliance, and building digital trust without compromising control.

Why Familiar Brands Feel Safer (Even When They’re Worse)

We’ve all stuck with a brand that disappointed us—slow shipping, bad UX, or frustrating support—simply because it felt familiar. This post breaks down the psychology behind why consumers trust known brands over better alternatives, how familiarity lowers perceived risk, and what challenger brands can do to win anyway.

Graduate Enrollment Isn’t a Brand Problem — Until It Is

Graduate enrollment marketing has long lived outside the university brand—optimized for leads, not trust. As universities segment more aggressively, misalignment is getting expensive. Here’s what’s breaking and how smarter institutions are fixing it.